Learn Intraday Trading And Earn Money Without Investment

Mastering the Art of Reading Trading Chart Patterns

Introduction:Trading chart patterns play a crucial role in technical analysis and can provide valuable insights for traders. By learning to interpret these patterns, traders can make informed decisions and enhance their trading strategies. In this blog, we will explore the basics of reading trading chart patterns and how to identify common patterns that occur in the financial markets.

Understanding Chart Patterns:Candlestick Charts: Start by familiarizing yourself with candlestick charts, which display price movements over a specific time period. Each candlestick represents the opening, closing, high, and low prices during that period.

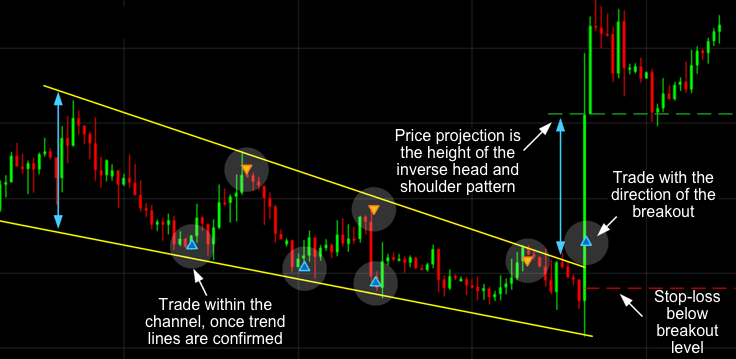

Trendlines: Trendlines help identify the direction of price movement and can be drawn by connecting a series of higher lows in an uptrend or lower highs in a downtrend.

Support and Resistance Levels: These are price levels where the buying (support) or selling (resistance) pressure is significant. They indicate potential turning points in the market.

Trendlines: Trendlines help identify the direction of price movement and can be drawn by connecting a series of higher lows in an uptrend or lower highs in a downtrend.

Support and Resistance Levels: These are price levels where the buying (support) or selling (resistance) pressure is significant. They indicate potential turning points in the market.

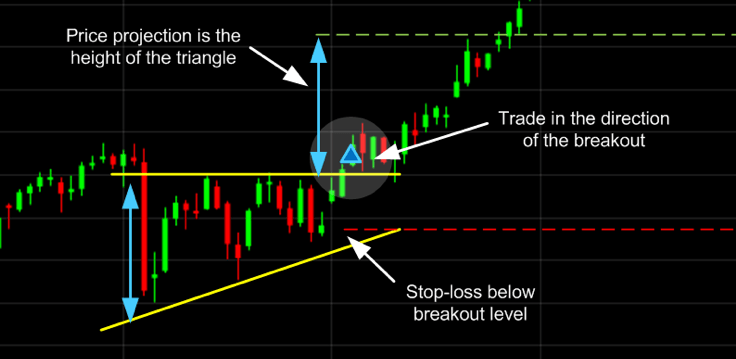

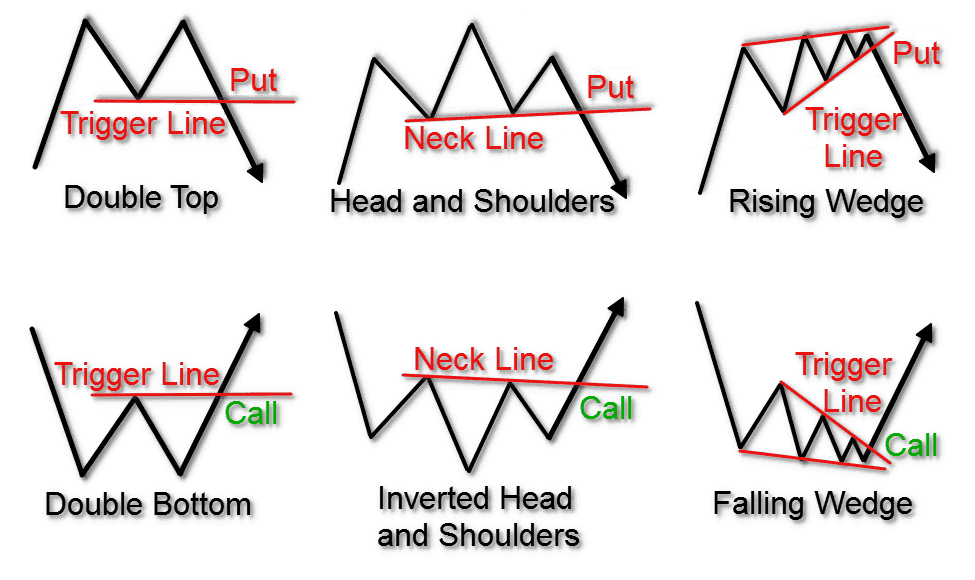

Common Chart Patterns:Double Tops and Double Bottoms: These patterns occur when the price reaches a high (double top) or low (double bottom) twice before reversing direction.

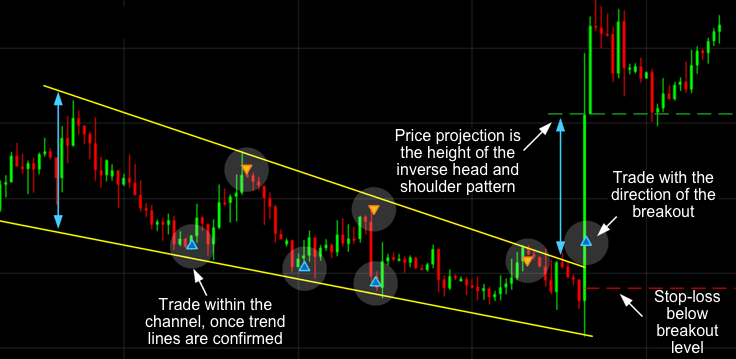

Head and Shoulders: This pattern consists of a central peak (head) with two smaller peaks (shoulders) on either side. It signals a potential trend reversal.

Flags and Pennants: These are short-term continuation patterns that represent a pause or consolidation within an existing trend.

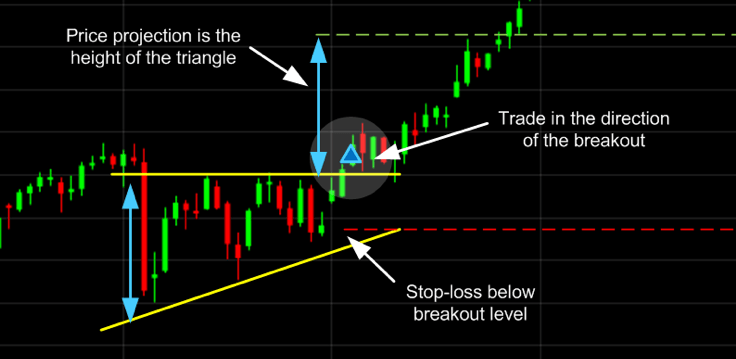

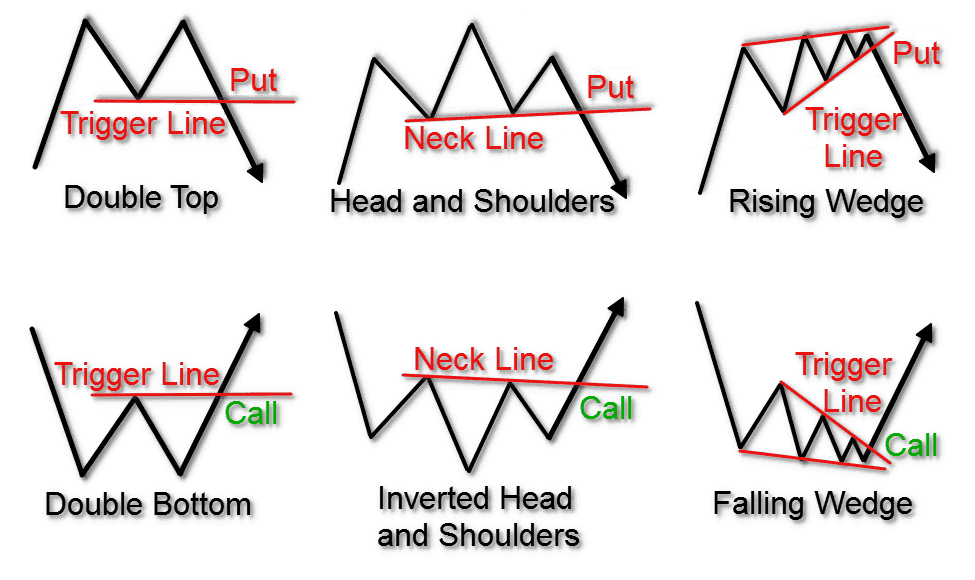

Triangles: Triangles are formed by converging trendlines and indicate a potential breakout or breakdown.

Analyzing Chart Patterns:Volume: Analyzing trading volume alongside chart patterns can provide confirmation of price movements and the strength of a pattern.

Analyzing Chart Patterns:Volume: Analyzing trading volume alongside chart patterns can provide confirmation of price movements and the strength of a pattern.

Timeframe: Consider the timeframe you are trading in. Different chart patterns may have different significances on various timeframes.

Confirmation: Wait for confirmation before making trading decisions. Additional indicators or price action can help validate a pattern.

Practice and Risk Management:Paper Trading: Utilize paper trading or demo accounts to practice identifying and trading chart patterns without risking real money.

Practice and Risk Management:Paper Trading: Utilize paper trading or demo accounts to practice identifying and trading chart patterns without risking real money.

Risk Management: Implement proper risk management strategies such as setting stop-loss orders to limit potential losses.

Head and Shoulders: This pattern consists of a central peak (head) with two smaller peaks (shoulders) on either side. It signals a potential trend reversal.

Flags and Pennants: These are short-term continuation patterns that represent a pause or consolidation within an existing trend.

Triangles: Triangles are formed by converging trendlines and indicate a potential breakout or breakdown.

Analyzing Chart Patterns:Volume: Analyzing trading volume alongside chart patterns can provide confirmation of price movements and the strength of a pattern.

Analyzing Chart Patterns:Volume: Analyzing trading volume alongside chart patterns can provide confirmation of price movements and the strength of a pattern.Timeframe: Consider the timeframe you are trading in. Different chart patterns may have different significances on various timeframes.

Confirmation: Wait for confirmation before making trading decisions. Additional indicators or price action can help validate a pattern.

Practice and Risk Management:Paper Trading: Utilize paper trading or demo accounts to practice identifying and trading chart patterns without risking real money.

Practice and Risk Management:Paper Trading: Utilize paper trading or demo accounts to practice identifying and trading chart patterns without risking real money.Risk Management: Implement proper risk management strategies such as setting stop-loss orders to limit potential losses.

Additional Tips for Trading Chart Patterns:Multiple Timeframe Analysis: Consider analyzing chart patterns across different timeframes to gain a broader perspective and confirm patterns.

Pattern Combinations: Look for combinations of chart patterns or multiple patterns forming in succession, as they can provide stronger trading signals.

Continuation and Reversal Patterns: Distinguish between continuation patterns, which suggest the current trend will continue, and reversal patterns, which indicate a potential trend change.

Pattern Failure: Be aware of pattern failures or false breakouts, where a pattern appears but fails to result in the expected price movement. Always wait for confirmation.

Market Conditions: Take into account the overall market conditions, including volatility, news events, and economic indicators, as they can impact the reliability of chart patterns.

Educate Yourself:Read Books and Resources: Invest time in reading books and online resources that delve into technical analysis and chart pattern recognition.

Attend Webinars and Seminars: Participate in webinars and seminars conducted by experienced traders or industry experts to gain valuable insights and learn practical strategies.

Conclusion: Reading trading chart patterns is a valuable skill that can enhance your trading decisions. It requires practice, patience, and continuous learning. By mastering the art of identifying chart patterns and understanding their implications, you can gain an edge in the financial markets. Remember to combine chart pattern analysis with other technical indicators, risk management strategies, and fundamental analysis for a comprehensive trading approach. Stay disciplined, be adaptable, and always strive to improve your trading skills through education and experience. Happy trading!

Pattern Combinations: Look for combinations of chart patterns or multiple patterns forming in succession, as they can provide stronger trading signals.

Continuation and Reversal Patterns: Distinguish between continuation patterns, which suggest the current trend will continue, and reversal patterns, which indicate a potential trend change.

Pattern Failure: Be aware of pattern failures or false breakouts, where a pattern appears but fails to result in the expected price movement. Always wait for confirmation.

Market Conditions: Take into account the overall market conditions, including volatility, news events, and economic indicators, as they can impact the reliability of chart patterns.

Educate Yourself:Read Books and Resources: Invest time in reading books and online resources that delve into technical analysis and chart pattern recognition.

Attend Webinars and Seminars: Participate in webinars and seminars conducted by experienced traders or industry experts to gain valuable insights and learn practical strategies.

Conclusion: Reading trading chart patterns is a valuable skill that can enhance your trading decisions. It requires practice, patience, and continuous learning. By mastering the art of identifying chart patterns and understanding their implications, you can gain an edge in the financial markets. Remember to combine chart pattern analysis with other technical indicators, risk management strategies, and fundamental analysis for a comprehensive trading approach. Stay disciplined, be adaptable, and always strive to improve your trading skills through education and experience. Happy trading!

If you want to learn trading buy course here : https://rpy.club/courses/qun5joGAqK

Post a Comment